And she never even used Spotify!

In May 2023, Molly Mickle, who lives in Washington Court House, Ohio, noticed a strange thing: her credit card was billed $9.99 by Spotify, a service she said she never used.

Despite disputing this charge and getting a new card, she kept seeing the same charge, again and again, leading her through the hassle of changing cards seven times in a few months.

Surprise Spotify Charges

Molly Mickle’s confusing experience with Spotify started in May 2023 when she spotted an odd $9.99 charge from the platform on her credit card bill.

This confused her because of two things. One, she never signed up on Spotify. Two, she hasn’t used her credit card in a year.

After noticing the charge, Mickle told her bank about the problem and got a new card. But the peace was short-lived.

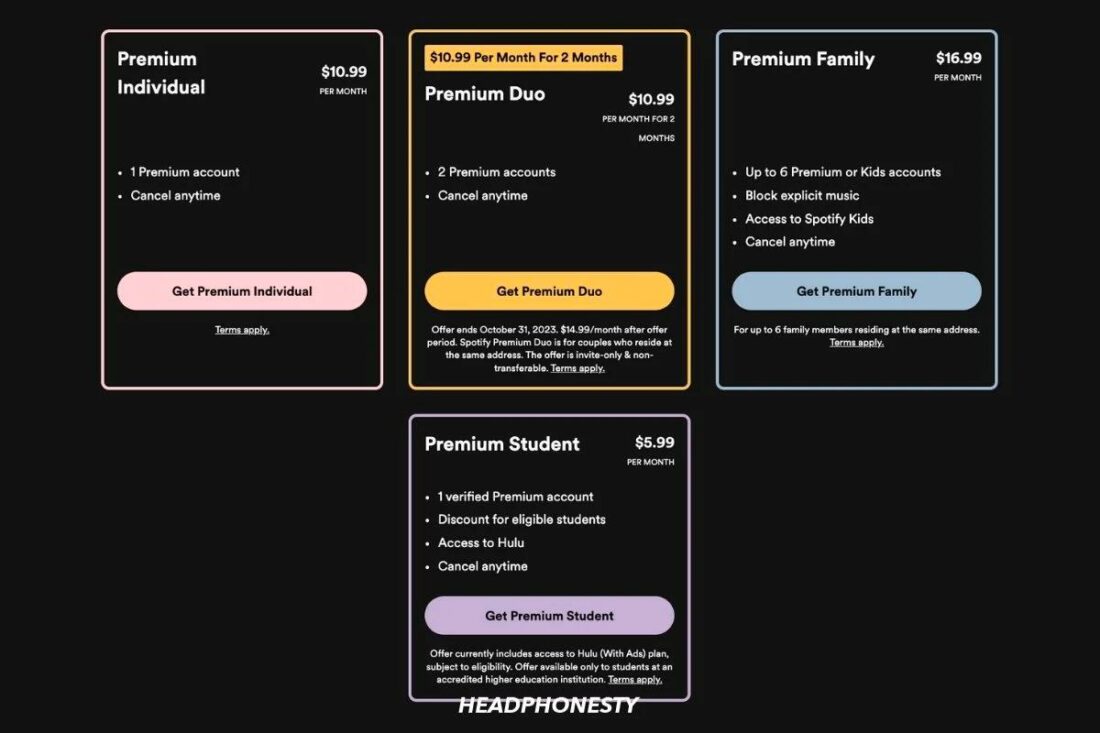

This began a frustrating cycle of disputing charges and getting new cards, only to see the charges return. The charges also climbed to $10.99 when Spotify increased their subscription fees.

Mickle’s bank didn’t make her pay for these charges, but she didn’t get any clear answers from the bank or Spotify about why this was happening. Fed up with the situation, Mickle decided to stop getting new cards and instead focus on raising awareness.

Investigation and Discovery

One day after Mickle shares her story, NBC4 receives a tip from a former debit card dispute specialist. Here, he said that the MasterCard’s Automatic Billing Updater is likely the main cause of the issue.

This service is designed to ensure seamless transactions for recurring payments by automatically updating card details for participating merchants. Meaning, this feature could allow charges to continue even when a user changes their card numbers.

So, if Mickle’s original card details were compromised for a Spotify subscription, the charges could persist across new card numbers due to this updater service.

The specialist said that Mickle wasn’t the only one who experienced this. He has handled multiple reports from different people because of similar issues. He also suggested that those affected should report their experiences to regulatory bodies such as the Federal Reserve Board, the Office of the Comptroller of the Currency, and the Consumer Financial Protection Bureau.

Deeper Issue on Spotify’s Unauthorized Charges

While the specialist explained why the charges kept repeating, it still didn’t clarify how the issue started. If Mickle never signed up for Spotify, how could the platform charge her the first time?

Mickle’s case is far from isolated. Across the border in Canada, Danielle Parent found herself in a bind when she noticed four Spotify charges she didn’t recognize. Each charge was $119.88, totaling to $479.52.

This left her account overdrawn, leaving her without money for groceries.

Similarly, Brenda Hawboldt discovered three Spotify charges totaling $359.64, despite never using her debit card online.

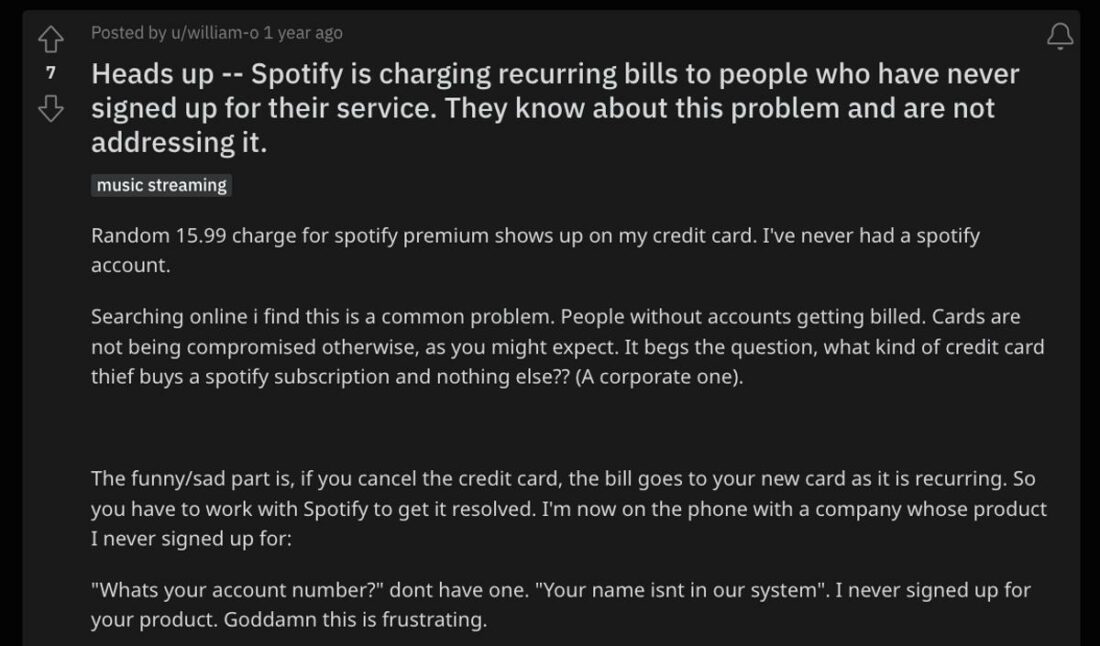

Online forums, especially Reddit, are also filled with people sharing similar frustrations.

One Reddit user, william-o, voiced confusion over a random Spotify charge, underscoring a broader issue, saying:

Responses From Banks and Spotify

In response to the unauthorized charges, banks worked with affected customers upon receiving their reports.

Mickle’s bank, for example, absorbed the disputed charges, issued her new cards, and flagged the charges as fraud.

Spotify, on its part, actively refunded the affected users and blocked accounts linked to unauthorized transactions, at least in Parent and Hawbolt’s cases.